Enhancing the Goldilocks Algorithm for Optimism Retro-Funding

Executive Summary

The Goldilocks algorithm is a key component of Optimism’s Retro-Funding Evaluation, designed to reward onchain builders (projects) that demonstrate steady and balanced contributions across multiple metrics, with a strong focus on retention. However, as Optimism Season 7 shifts its priority to driving Total Value Locked (TVL), the current weight configuration reveals a significant limitation: it favors established projects while overlooking "rising stars"—emerging projects with shorter track records but substantial growth potential and impact. This exclusion risks undervaluing innovative contributors critical to achieving Season 7’s TVL objectives. This report examines these shortcomings, proposes refined metric and variant weights, and demonstrates how these adjustments better align with Optimism’s goal of rewarding impact while preserving the algorithm’s foundational strengths.

1. Introduction

Optimism’s Retro-Funding initiative aims to promote growth, adoption, and sustainability within the Superchain ecosystem. The Goldilocks algorithm supports this mission by assessing projects through a combination of metrics and variants, historically emphasizing retention to encourage consistent contributions. With Season 7’s strategic focus on driving Total Value Locked (TVL), however, the algorithm’s current design—featuring equal metric weights and a retention-heavy structure—falls short. A major limitation is its inability to adequately recognize rising stars, whose rapid growth and potential impact are vital to ecosystem expansion. This report details the deficiencies of the existing setup and proposes targeted adjustments to better align the algorithm with Season 7’s TVL-driven priorities, while maintaining its commitment to balanced performance evaluation.

2. Shortcomings of the Current Weight Configuration

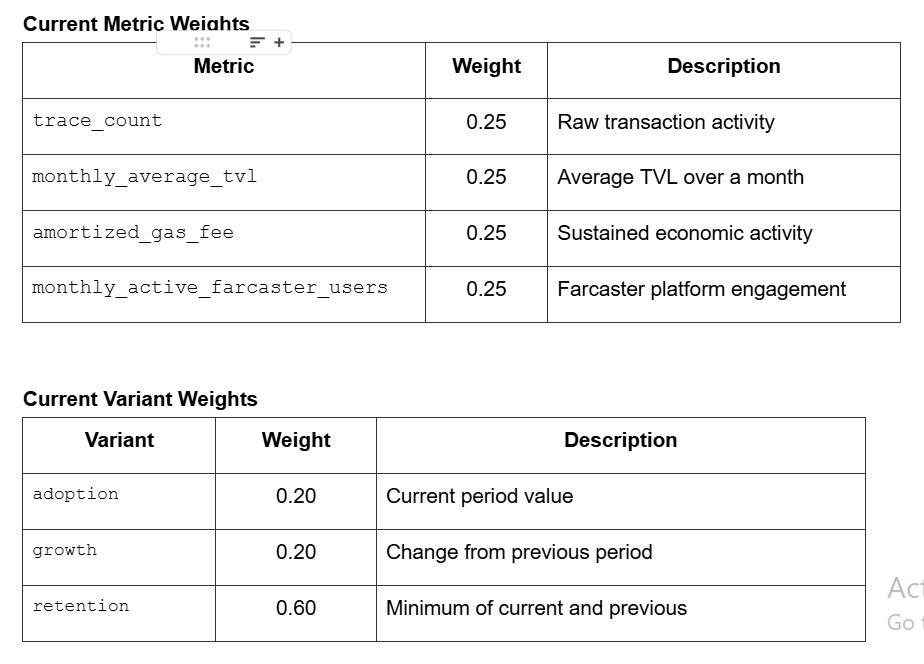

The current Goldilocks algorithm employs the following weights:

2.1 Equal Metric Weights Undermine TVL Focus and Exclude Rising Stars

Issue: All metrics are weighted equally at 0.25, despite total value locked (TVL) being Season 7’s primary target. Metrics like trace_count and monthly_active_farcaster_users, while informative, do not directly contribute to TVL and dilute the focus on value-centric projects. Furthermore, this equal weighting overlooks the unique strengths of rising stars, which often demonstrate strong growth metrics rather than established performance.

Impact: Established projects with stable but stagnant metrics may outscore rising stars with significant growth potential, misaligning rewards with Season 7’s goal of ecosystem expansion through TVL growth.

2.2 Vulnerability to Artificial Activity

Issue: The lack of bot-filtered metrics (e.g., transaction_count_bot_filtered) allows unverified or artificial activity to influence scores.

Impact: Projects with inflated metrics due to bot activity could receive undeserved rewards, compromising fairness and the recognition of genuine value creation.

2.3 Platform Bias Towards Farcaster

Issue: Relying exclusively on monthly_active_farcaster_users restricts community assessment to a single platform.

Impact: Projects with robust engagement on alternative platforms (e.g., X, Discord) are undervalued, reducing inclusivity and potentially excluding rising stars that thrive on diverse channels.

3. Proposed Adjustments

The proposed changes recalibrate the algorithm by structuring the metric weights into three key categories—TVL Drivers, Transactions, and User Metrics—following a 50-30-20 weighting approach. This framework reflects Retro-Funding’s methodology of evaluating onchain impact through financial commitment (TVL), transaction activity, and user adoption, while emphasizing growth to spotlight rising stars.

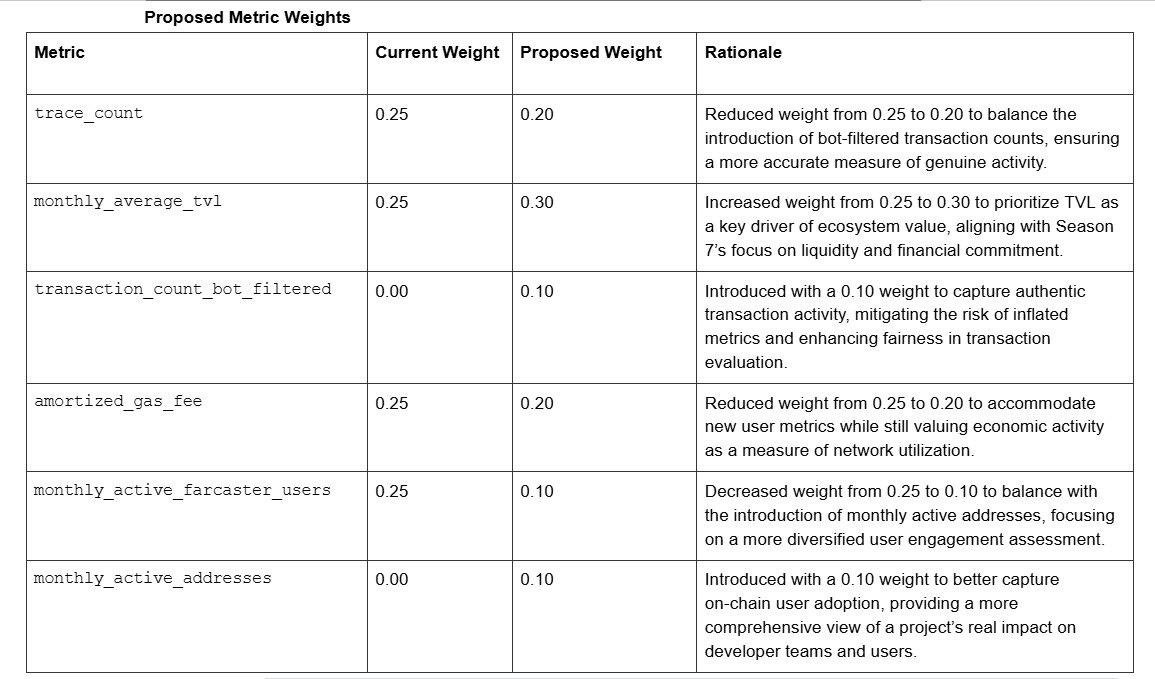

Proposed Metric Weights

Understanding the 50-30-20 Metric Weight Categories

TVL Drivers (50%):

monthly_average_tvl: 0.30

amortized_gas_fee: 0.20

Transaction Drivers (30%):

trace_count: 0.20

transaction_count_bot_filtered: 0.10

User Metrics (20%):

monthly_active_farcaster_users: 0.10

monthly_active_addresses: 0.10

This 50-30-20 split prioritizes financial commitment (TVL) as the primary driver, supported by transaction activity and user adoption metrics. The increased growth weight of 0.30 in the variant weights ensures that rising stars—projects demonstrating strong upward momentum—are adequately recognized.

4. Rationale for Proposed Changes

These adjustments address previous shortcomings, align the algorithm with Season 7’s TVL-focused objectives, and ensure rising stars are rewarded through a clear, impact-driven structure.

4.1 Prioritizing TVL Drivers (50% Weight)

Change: monthly_average_tvl increases from 0.25 to 0.30.

Reason: As the primary measure of ecosystem value, TVL is elevated to anchor the 50% TVL Drivers category. This shift ensures projects contributing to Season 7’s core goal are prioritized, particularly rising stars with growing TVL, while amortized_gas_fee (0.20) complements it by capturing sustained economic activity.

4.2 Incentivizing Growth to Recognize Rising Stars

Change: growth increases from 0.20 to 0.30; adoption decreases from 0.20 to 0.10.

Reason: Elevating the growth variant rewards projects with upward trajectories, a defining trait of rising stars critical for ecosystem expansion. The strong retention weight (0.60) maintains stability, while the reduced adoption weight shifts focus from current scale to future potential.

4.3 Ensuring Authentic Transaction Activity (30% Weight)

Change: Introduces transaction_count_bot_filtered at 0.10; reduces trace_count from 0.25 to 0.20.

Reason: The Transaction Drivers category (30%) now balances raw activity (trace_count) with authentic engagement (transaction_count_bot_filtered). This ensures rewards reflect genuine usage, which is especially important for rising stars that may face early-stage metric inflation.

4.4 Broadening User Metrics (20% Weight)

Change: Reduces monthly_active_farcaster_users from 0.25 to 0.10; adds monthly_active_addresses at 0.10.

Reason: Diversifying community metrics mitigates platform bias and captures broader user adoption. This fosters inclusivity, benefiting rising stars active across multiple platforms beyond Farcaster.

4.5 Refining Existing Metrics

Change: amortized_gas_fee decreases from 0.25 to 0.20; trace_count decreases from 0.25 to 0.20.

Reason: These reductions free up weight for more strategic metrics like monthly_average_tvl and transaction_count_bot_filtered. This refines the algorithm to focus on meaningful growth indicators, ensuring rising stars are evaluated on impactful contributions rather than less relevant signals.

5. Conclusion

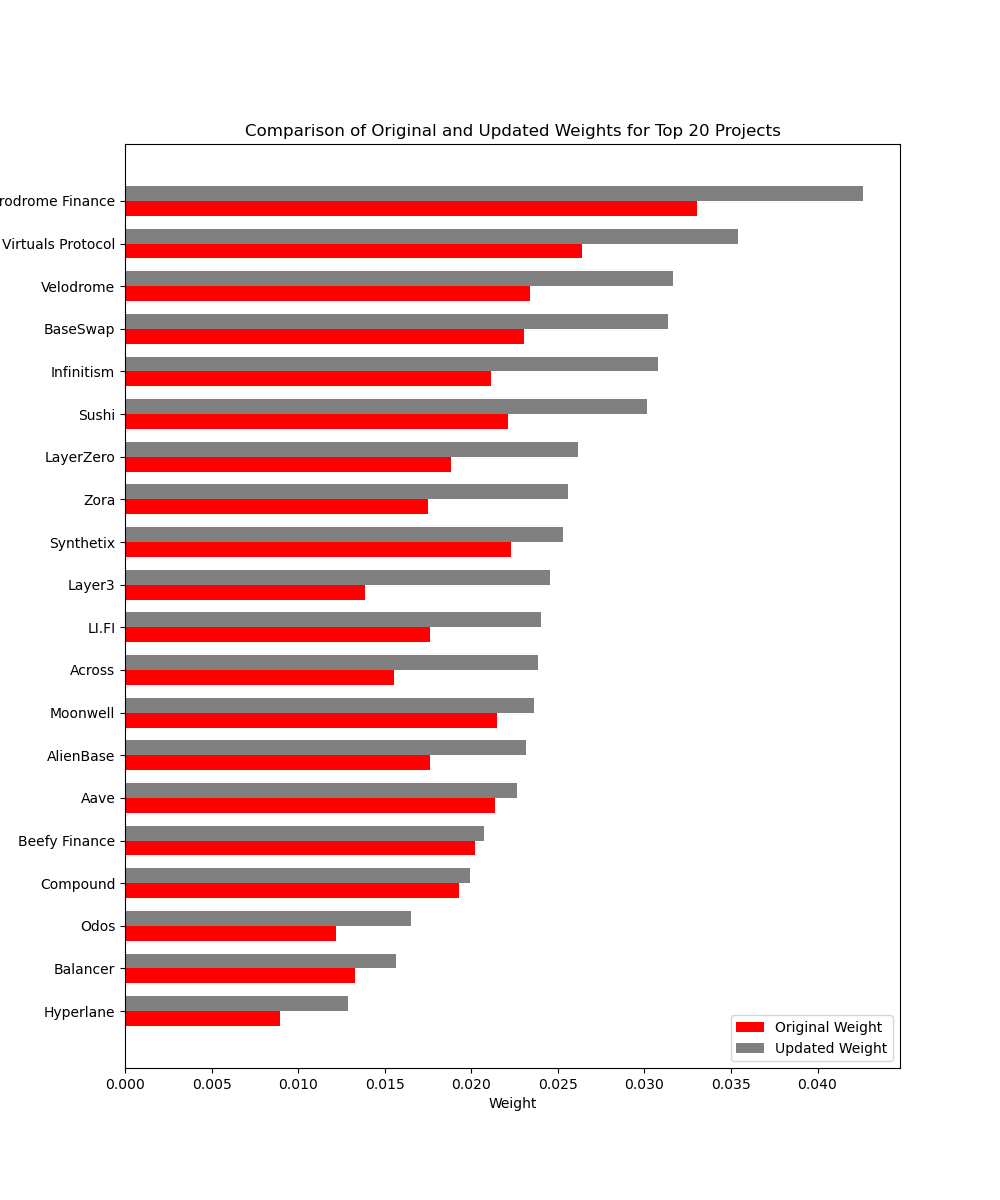

The proposed adjustments to the Goldilocks algorithm offer a strategic overhaul that directly addresses its existing limitations while aligning with the core objectives of Optimism Season 7. These refinements ensure the algorithm not only drives Total Value Locked (TVL) but also fosters a fair, inclusive, and resilient Superchain ecosystem.

Here’s how these changes deliver impactful improvements:

Prioritizing TVL: By assigning a higher weight to monthly_average_tvl, the algorithm shifts its focus to reward projects that significantly contribute to TVL, a key metric for Optimism Season 7’s success.

Balancing Retention and Growth: The updated framework enhances the growth variant to incentivize expansion, while still valuing retention, ensuring both rising stars and established projects are fairly rewarded for their contributions.

Enhancing Authenticity: Introducing bot-filtered metrics mitigates the risk of artificial activity, strengthening the integrity and reliability of the evaluation process.

Broadening Inclusivity: Expanding community metrics beyond platform-specific biases (e.g., Farcaster) promotes diverse engagement, making the algorithm more equitable and representative of the broader ecosystem.

These adjustments align the Goldilocks algorithm with Optimism Season 7’s mission to drive TVL, while preserving its foundational commitment to rewarding consistent and balanced project performance. By adopting this refined framework, Optimism empowers both established contributors and emerging innovators, laying the groundwork for sustained growth, fairness, and profitability of the Superchain ecosystem.