Bitcoin Data Analysis

The approval of spot Bitcoin ETFs, coupled with rising user activities and an all-time high hashrate, paints a positive outlook for Bitcoin's future.

The Bitcoin ecosystem has continued to capture attention due to significant developments, including the SEC's approval of 11 spot Bitcoin ETFs, the rise of NFT ordinals, and the introduction of BRC-20 smart contracts on the Bitcoin network.

As a Data Analyst and Crypto Enthusiast, I've delved into Dune Analytics, querying the Bitcoin database to track essential onchain trends that can guide our investment decisions.

In this first part of my Bitcoin data analysis, I'll present key insights from a Dune dashboard that covers fundamental metrics such as price, user activities, hash rate, block rewards, and miner’s lifetime revenue.

For a comprehensive view, you can explore the complete Bitcoin Data Dashboard on Dune.

BTC Price pushes above $42k

The approval of spot Bitcoin ETFs appeared to trigger a "sell the news" event, prompting profit-taking by numerous whales as the price touched $49,000. Additionally, the Grayscale Bitcoin Trust (GBTC) experienced outflows of $429 million, leading BTC to reach a low of $39,000 within the last 14 days.

Despite this, insights from the BTC price chart below indicate an uptrend, reaching a high of $42,209 as of the time of writing.

Inflows across all spot Bitcoin ETFs currently stand at $1.13 billion, suggesting more institutional demand for BTC while supply continues to shrink as we approach the next Bitcoin halving.

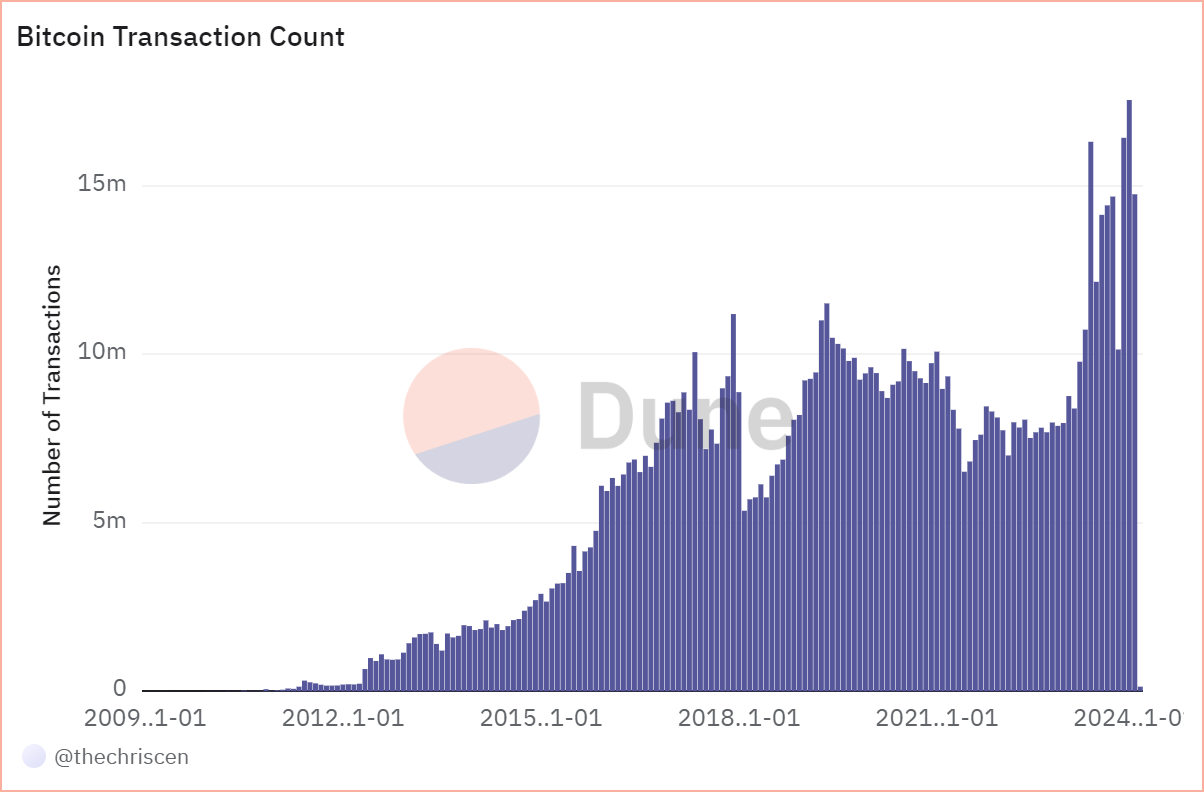

Users Transactions hits 14 million.

The health of a blockchain network is often gauged by user and developer activities. According to Dune data, transaction counts by users currently stand at 14.74 million, indicating growing momentum despite the sharp decline in the previous month due to price fluctuations.

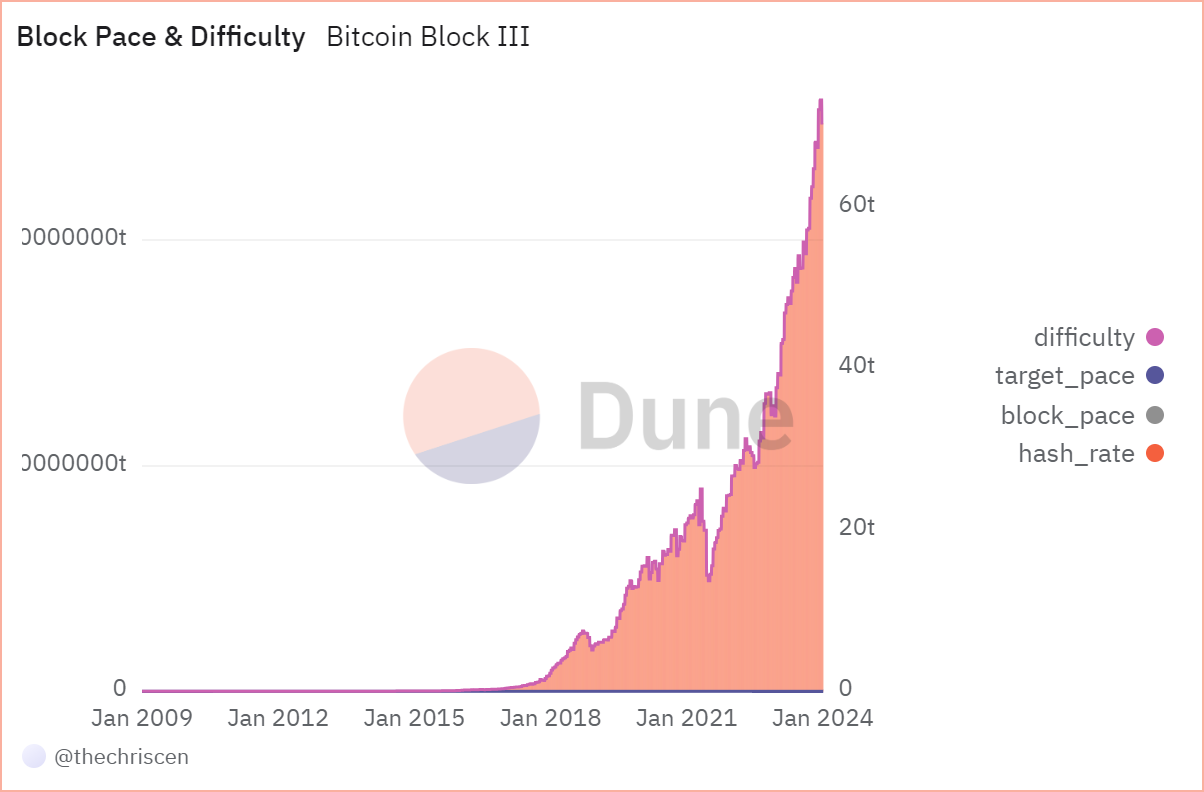

Bitcoin Hash rate and difficulty continues to rise

Bitcoin's proof-of-work (PoW) network demands robust computational power from miners, directly influencing the hash rate and mining difficulty.

The current hash rate stands at 523.918 EH/s, with mining difficulty at block height 827,468 reaching 70.34 T.

The continuous rise in the mining difficulty and hash rate enhances the security of the Bitcoin network, making it incredibly hard for attacks.

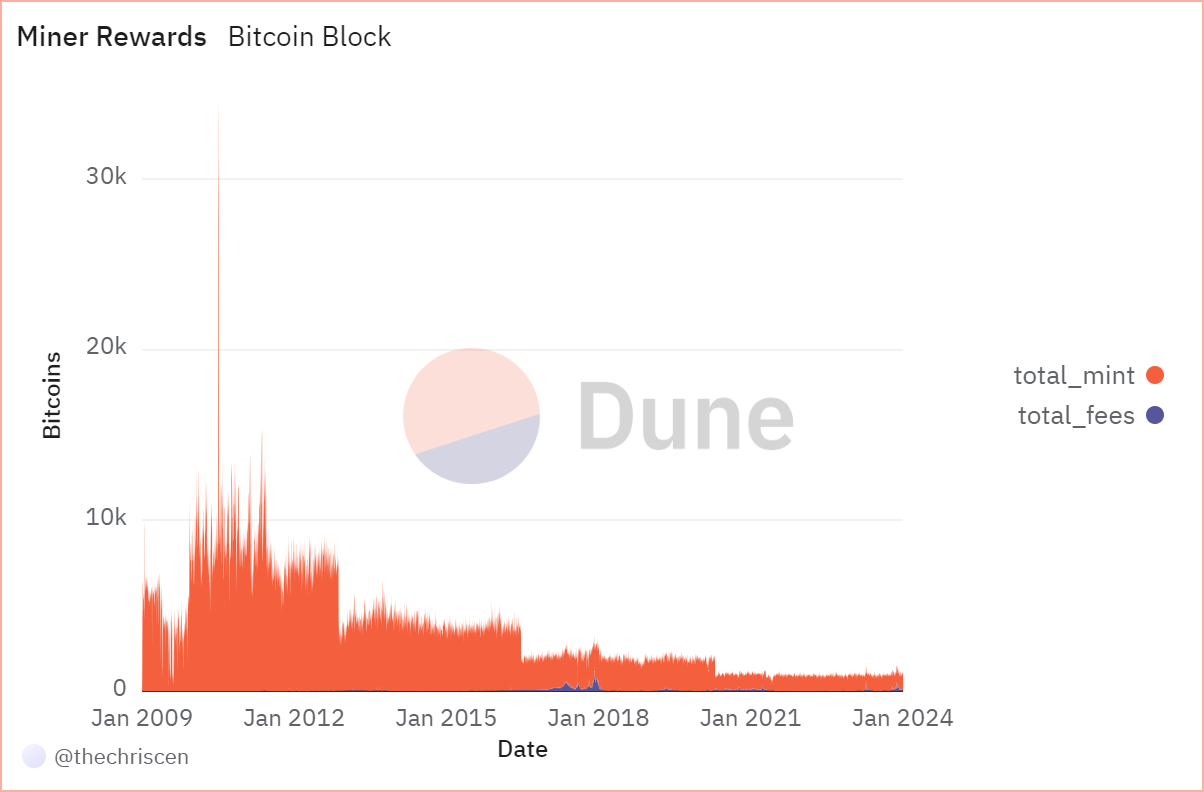

Bitcoin Miners earn $48 million in 24 hours

Miners compete to approve transactions on the Bitcoin network, in exchange for rewards in BTC.

Dune Data reveals that in the past 24 hours, Bitcoin miners generated approximately $48 million, pushing their lifetime revenue above $861.5 billion.

Conclusion

The approval of spot Bitcoin ETFs, along with the surge in user activities and the record-setting hashrate, presents a positive outlook for Bitcoin's future despite short-term market fluctuations.

As we anticipate the 4th cycle of the halving, BTC supply will continue to shrink, and the price is expected to rise. The big question today is, how high can BTC soar from here?

-

Until next week, remember that…

Fortune Favours the Bold